Bitcoin Migration: What It Means, Why It Matters, and Where It’s Headed

When people talk about Bitcoin migration, the movement of Bitcoin activity from one network, jurisdiction, or infrastructure to another. Also known as Bitcoin network shift, it isn’t just about sending coins—it’s about where those coins live, who controls them, and how the rules around them are changing. This isn’t science fiction. It’s happening right now, quietly, across mining rigs in Iran, tax lawyers in Estonia, and node operators in Norway.

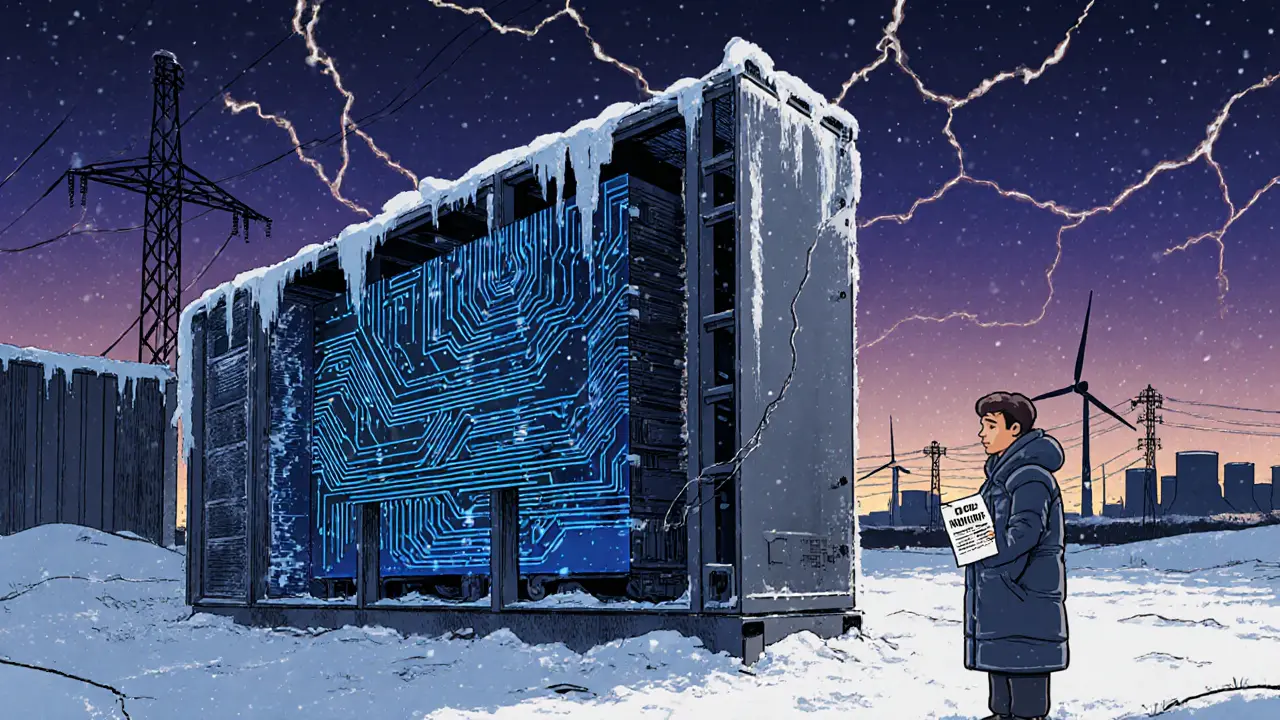

One big piece of this puzzle is Bitcoin nodes, the computers that verify and store the full Bitcoin blockchain. Also known as full nodes, they keep the network honest. In 2025, the number of active nodes is more than just a statistic—it’s a measure of decentralization. If nodes drop in one country and spike in another, that’s a migration. Countries like Norway are pausing new mining data centers to save renewable power, while Iran’s IRGC runs illegal mines using stolen electricity. Meanwhile, places like Nigeria and Indonesia are rewriting crypto rules, forcing traders to shift platforms or rethink where they hold assets. This isn’t random—it’s a global reshuffling. And it’s not just about mining. Crypto tax relocation, the legal move of your residence to a country with better crypto tax treatment. Also known as crypto tax migration, it’s a real strategy for people holding large Bitcoin positions. Legal fees for this can hit $250,000, but for some, it’s worth it to avoid 40%+ capital gains taxes. These moves directly impact where Bitcoin is traded, stored, and taxed. You can’t separate Bitcoin migration from cryptocurrency regulation, the laws governments create to control how crypto is used, taxed, and traded. Also known as crypto compliance rules, they’re pushing exchanges like Bitpin and SatoExchange to tighten KYC, block users, or shut down entirely in certain regions. When Indonesia reclassifies crypto from a commodity to a digital financial asset, or Nigeria demands SEC licensing, traders have to move—either their funds, their accounts, or themselves.

And behind all this? The quiet infrastructure. Decentralized exchanges let you trade without relying on centralized platforms that can be shut down. Smart contract wallets give you control without a middleman. Mempool priority determines how fast your transaction goes through when networks get crowded. These aren’t side notes—they’re the tools that make Bitcoin migration possible. You’re not just moving coins. You’re moving your entire crypto strategy.

Below, you’ll find real-world examples of how this plays out: from unlicensed mining in Iran to tax relocation costs in Europe, from node counts that signal network health to exchanges that adapt—or die. This isn’t theory. It’s what’s happening now. And if you’re holding Bitcoin, you’re already part of it.

Bitcoin Hash Rate Migration from Kazakhstan: Why Miners Are Leaving and Where They're Going

Bitcoin miners are leaving Kazakhstan due to power shortages and regulatory pressure, shifting operations to the U.S. and Canada. Despite the exodus, global hash rate hits record highs, proving Bitcoin's network is growing stronger - not weaker.