Iran Crypto Sanctions: What They Mean for the Crypto World

When dealing with Iran crypto sanctions, government-imposed restrictions that block Iranian entities from accessing global crypto services. Also known as Iranian sanctions on digital assets, they force exchanges, wallets, and DeFi platforms to rethink how they serve users linked to Iran. The rules stem mainly from the U.S. Treasury’s OFAC program, which targets illicit finance and nuclear proliferation concerns.

Key Players and How They Interact

One major player is the cryptocurrency exchange, a digital marketplace where users trade tokens and coins. Exchanges must screen wallet addresses, IP locations, and KYC data to avoid breaching OFAC sanctions, U.S. regulations that penalize dealings with prohibited parties. Failure to comply can lead to hefty fines or loss of banking relationships. Another crucial element is blockchain compliance, the suite of tools and policies used to meet legal requirements on a distributed ledger. Compliance suites scan transaction graphs, flag high‑risk entities, and automate reporting, helping exchanges stay within legal bounds while still offering services to legitimate users.

The interplay of these entities creates clear semantic connections: Iran crypto sanctions influence cryptocurrency exchanges by demanding stricter KYC; OFAC sanctions drive the development of blockchain compliance tools; and robust blockchain compliance enables exchanges to operate under the pressure of Iran crypto sanctions. These triples illustrate the cause‑effect chain that shapes market behavior.

For traders, the sanctions translate into limited access to certain tokens and higher transaction costs. Many avoid Iranian‑linked wallets altogether to sidestep potential freezes. Others turn to decentralized exchanges (DEXs) that don’t require identity verification, though even DEXs face scrutiny as regulators expand the definition of “service provider.” The result is a fragmented landscape where compliance becomes a competitive advantage—exchanges that can quickly and accurately apply sanctions filters attract risk‑averse users.

Lastly, regulators worldwide watch how sanctions affect crypto flow. When Iran’s assets are blocked, illicit actors may seek alternative routes, prompting tighter AML (anti‑money‑laundering) guidelines across the board. This regulatory ripple forces new policy drafts, influences token listings, and even impacts tokenomics for projects aiming to launch in sanctioned regions. By understanding the ecosystem—exchanges, OFAC rules, and compliance tech—you can better anticipate market shifts and plan strategies that respect the law while staying profitable.

Below you’ll find a curated set of articles that break down exchange reviews, staking guides, tax implications, and more—all viewed through the lens of Iran crypto sanctions. Dive in to see how each piece connects to the broader compliance puzzle.

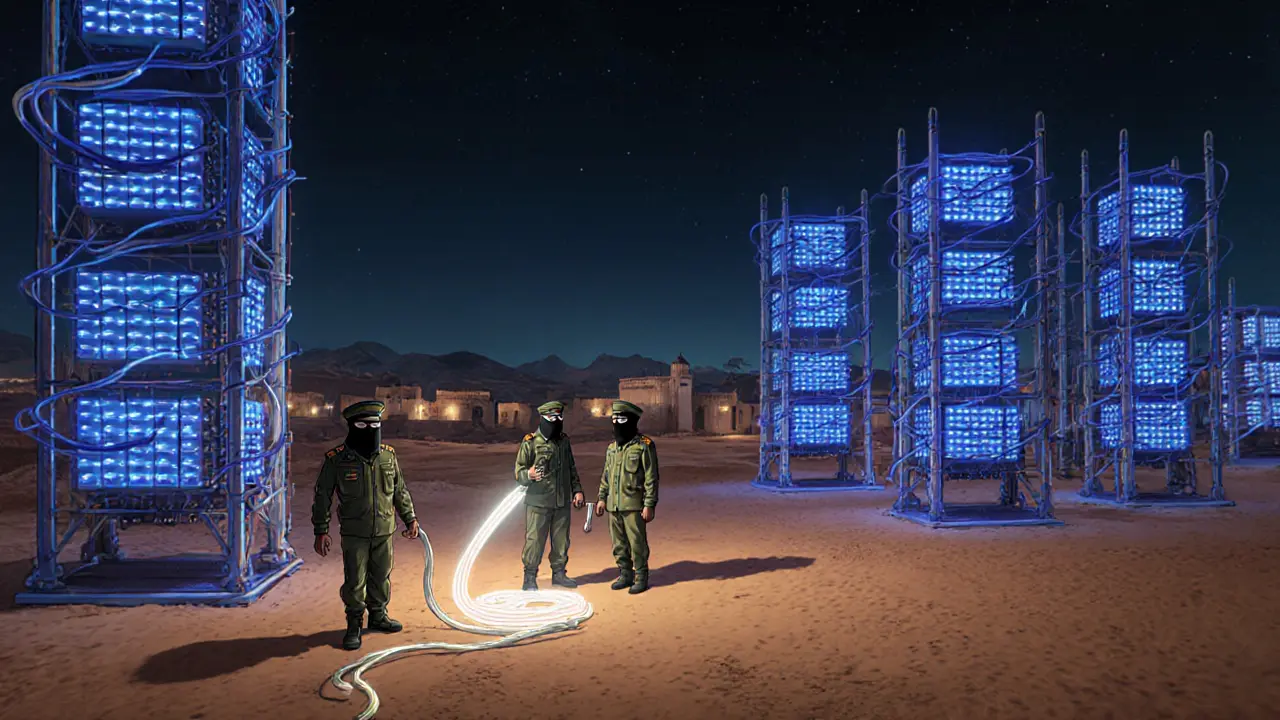

IRGC’s Unlicensed Crypto Mining in Iran: How the Guard Exploits Power

Explore how Iran's Islamic Revolutionary Guard Corps runs unlicensed crypto mines, steals cheap power, evades sanctions, and fuels the country's energy crisis.

- 25

- Read More