Bitcoin mining Iran: Regulations, Energy, and Profitability

When looking at Bitcoin mining Iran, the practice of generating new Bitcoin blocks using hardware located within the borders of Iran. Also known as Iranian Bitcoin mining, it sits at the crossroads of energy policy, finance law, and tech adoption. The sector is tightly linked to cryptocurrency regulation, government rules that dictate how digital assets can be used, taxed, or restricted and depends heavily on renewable energy, power generated from wind, solar, or hydro sources that miners tap to keep electricity costs low. In plain terms, Bitcoin mining Iran requires compliance with cryptocurrency regulation and thrives where renewable energy is abundant. This relationship forms a core semantic triple: Bitcoin mining Iran → requires → cryptocurrency regulation, and another: Bitcoin mining Iran → benefits → renewable energy. Iranian authorities have issued specific licensing rules for mining farms, and miners must register equipment to avoid penalties, making legal compliance a daily operational task.

One of the biggest questions miners ask is how mining profitability, the net gain after accounting for hardware, electricity, and fees stacks up against the market. Iran’s crypto policy, the set of laws and guidelines issued by the Iranian government to control digital assets directly influences that calculation by shaping tax rates and permitting certain exchanges. When the grid supplies cheap solar power, miners report hash rates soaring while costs stay flat. Conversely, sudden policy shifts—like tighter licensing or bans on specific exchanges—can turn a profitable operation into a loss overnight. The third semantic triple emerges: Iranian crypto policy → affects → mining profitability. Besides policy, hardware efficiency matters; the latest ASIC models can deliver up to 140 TH/s while drawing less than 3 kW, cutting the electricity bill dramatically. Yet the same devices need stable power, and frequent grid interruptions in some provinces force operators to invest in backup generators, raising capital expenditures. Understanding how policy, energy tariffs, and hardware efficiency interact helps operators decide whether to expand capacity, relocate, or switch to more energy‑efficient equipment.

What you’ll find in our collection

The articles below dive into real‑world examples of Iran’s mining landscape, from Norway’s temporary ban on new data centers to the impact of memecoins on transaction fees. You’ll see detailed analyses of how renewable‑energy incentives shape hash power, why regulatory changes cause trading volume to dip, and step‑by‑step guides for staking or running a node in a restrictive environment. We also cover the legal costs of crypto tax relocation, the mechanics of peer discovery in Bitcoin networks, and the role of decentralized exchanges in bypassing local bans. Whether you’re a hobbyist looking to set up a small rig, an investor gauging the country’s long‑term outlook, or a policy watcher tracking how sanctions affect mining equipment imports, this roundup gives you the context you need to make informed decisions about Bitcoin mining in Iran. Explore the breadth of coverage and grab actionable insights that prepare you for the next regulatory shift or energy price swing.

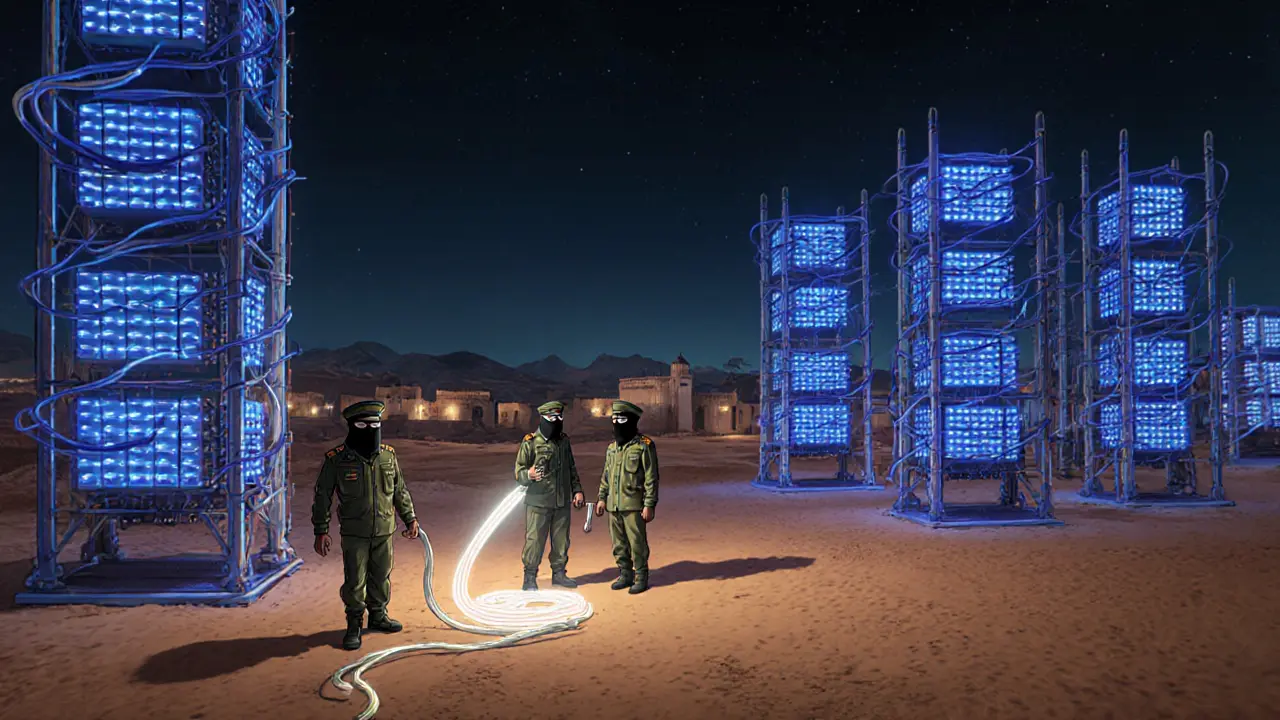

IRGC’s Unlicensed Crypto Mining in Iran: How the Guard Exploits Power

Explore how Iran's Islamic Revolutionary Guard Corps runs unlicensed crypto mines, steals cheap power, evades sanctions, and fuels the country's energy crisis.

- 25

- Read More

How Iran Uses Cryptocurrency to Bypass Sanctions in International Trade

Explore how Iran leverages cryptocurrency, mining farms, and exchanges like Nobitex to evade sanctions and keep international trade flowing, plus the risks and compliance lessons.

- 18

- Read More