Bitcoin Hash Rate: What It Is, Why It Matters, and How It Shapes Crypto Security

When you hear Bitcoin hash rate, the total computational power being used to mine Bitcoin and secure its blockchain. Also known as network hashrate, it’s the heartbeat of Bitcoin’s security. Think of it like a giant digital lock—every second, thousands of machines around the world race to solve complex math puzzles. The faster they solve them, the higher the hash rate, and the harder it becomes for anyone to hack or manipulate the network. No single entity can control this system because it’s spread across continents, powered by everything from home rigs to warehouse-sized data centers.

It’s not just about security—it’s about trust. A rising Bitcoin hash rate means more miners are joining, which usually signals confidence in Bitcoin’s future. But it also means more electricity is being used. That’s why places like Norway are now pausing new mining projects—to protect their renewable energy for other needs. Meanwhile, in Iran, the IRGC runs illegal mines using subsidized power, showing how hash rate isn’t just technical—it’s political and economic too. And when the mining difficulty adjusts every two weeks, it’s the network’s way of keeping the pace steady, no matter how many new machines come online.

Miners don’t just compete—they enable the whole system. Every Bitcoin transaction gets confirmed because of this constant computational race. Without a high hash rate, the network becomes vulnerable. A drop in hash rate could mean fewer miners, weaker security, and even price instability. That’s why when a major mining farm shuts down—or when regulations change, like in Nigeria or Indonesia—the market watches closely. The Bitcoin nodes count, which you’ll find covered in other posts, works hand-in-hand with hash rate. Nodes verify transactions; miners create them. Together, they keep Bitcoin decentralized and alive.

So when you see headlines about Bitcoin’s hash rate hitting a new all-time high, it’s not just a number—it’s proof that the network is growing stronger. But it’s also a reminder that Bitcoin’s future depends on who’s powering it, where, and at what cost. Below, you’ll find real-world examples of how mining, regulation, and energy use are shaping Bitcoin’s path—from state-backed operations to grassroots miners trying to stay profitable. These aren’t abstract theories. They’re happening now, and they directly affect how secure your Bitcoin is.

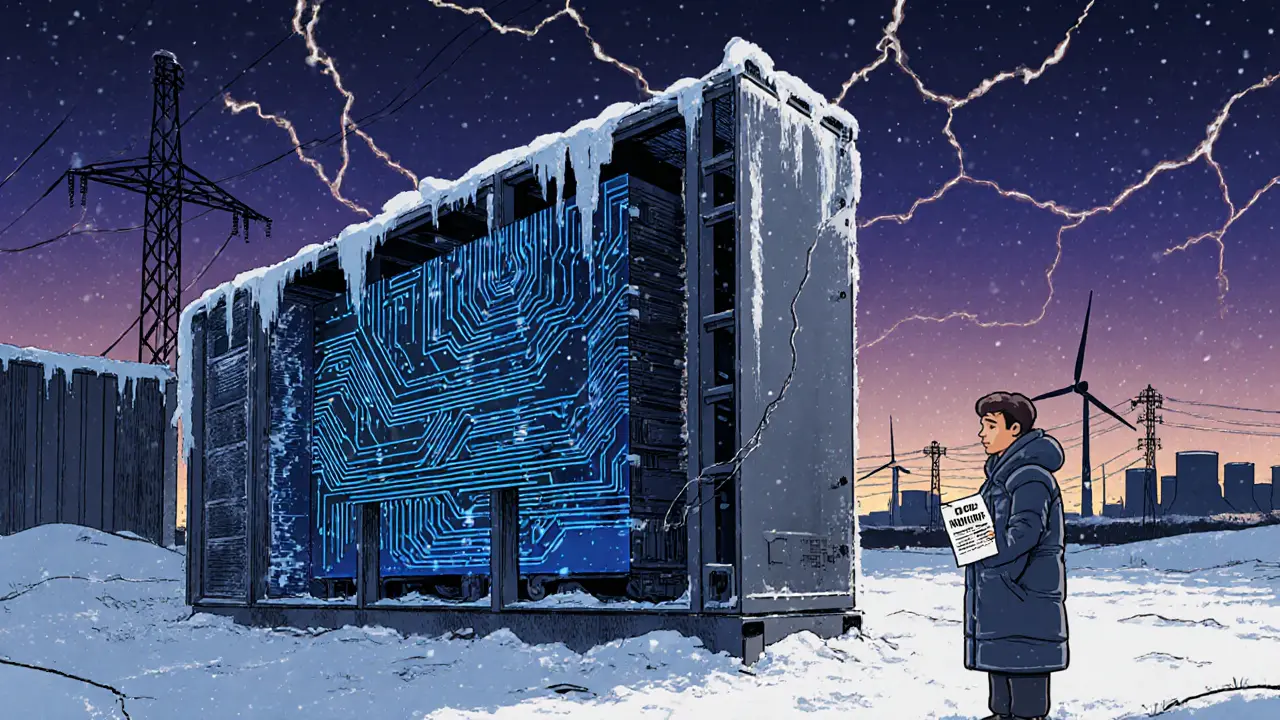

Bitcoin Hash Rate Migration from Kazakhstan: Why Miners Are Leaving and Where They're Going

Bitcoin miners are leaving Kazakhstan due to power shortages and regulatory pressure, shifting operations to the U.S. and Canada. Despite the exodus, global hash rate hits record highs, proving Bitcoin's network is growing stronger - not weaker.