Raydium Transaction Fee Calculator

Compare Your Trading Costs

See how much you save with Raydium's low fees compared to Ethereum-based DEXs.

Your Savings

Enter a trade amount to see results

When you’re trading crypto on a decentralized exchange, speed and cost matter. If you’ve been eyeing Solana-based platforms, you’ve probably heard of Raydium. But is it actually good to use in 2025? Or is it just another high-risk DeFi project with flashy numbers and shaky trust? Let’s cut through the noise.

What Is Raydium?

Raydium is a decentralized exchange (DEX) built directly on the Solana blockchain. Launched in early 2021, it wasn’t just another copy of Uniswap. It was designed to merge two trading models: Automated Market Makers (AMMs) and order books. That’s rare. Most DEXs use one or the other. Raydium uses both - by connecting to Serum, Solana’s native order book exchange. This gives users access to deeper liquidity and tighter spreads than most AMMs can offer.

Unlike centralized exchanges like Binance or Coinbase, Raydium doesn’t hold your funds. You connect your wallet - Phantom, Solflare, or Coin98 - and trade directly from there. That means no KYC, no account freezes, and no customer service to call when something goes wrong. It’s pure DeFi: you’re in control, but you’re also on your own.

How Does Raydium Compare to Other DEXs?

Let’s be real: Raydium doesn’t win on user experience. Traders Union gave it a 1.86 out of 10 - one of the lowest scores among major DEXs. That’s not a typo. It’s lower than many newer, less-known platforms. Why? Because while the tech is solid, the interface is clunky, documentation is thin, and mobile support is just a browser tab.

Compare that to Uniswap on Ethereum. Uniswap’s UI is smoother, it has more tutorials, and it’s been around longer. But here’s the trade-off: Uniswap transactions can cost $20-$100 during peak times. Raydium? You’re paying under $0.01 per trade. That’s not even a coffee cup’s worth of change.

And speed? Solana processes 65,000 transactions per second. Ethereum? Around 15. That’s why Raydium trades settle in under a second. If you’re swapping SOL for USDC or trading new Solana memecoins, speed is everything.

Trading on Raydium: Fees, Pairs, and Limits

Raydium charges a flat 0.25% fee on every trade. No maker-taker split. No hidden charges. That’s competitive. Most centralized exchanges charge 0.1%-0.5%, and some even offer fee discounts. But Raydium’s fee is predictable. You know exactly what you’re paying.

The platform supports over 6,100 tokens - everything from SOL and USDC to obscure Solana-based tokens you’ve never heard of. You won’t find Bitcoin or Ethereum directly traded on Raydium, but you can swap wrapped versions like wBTC and wETH. That’s standard for Solana DEXs.

No leverage. No stop-loss orders. No margin trading. That’s a double-edged sword. If you’re new to crypto, this keeps you safe from blowing up your account. If you’re a pro trader, you’ll miss those tools. Raydium isn’t built for advanced strategies. It’s built for quick swaps and liquidity provision.

Raydium’s RAY Token: Value and Volatility

The RAY token is the backbone of Raydium’s ecosystem. It’s used for governance, staking, and earning rewards in liquidity pools. As of October 2025, RAY trades between $1.82 and $2.61, depending on the data source. That’s a far cry from its all-time high of $16.93 in September 2021.

Market cap sits around $600 million, ranking it roughly #99-#100 in crypto. Circulating supply is 290 million out of a total 555 million tokens. That’s a decent burn rate - over 47% of tokens are still locked or unissued.

Price predictions are all over the place. DigitalCoinPrice says RAY could hit $7.23 by end of 2025. Changelly’s more conservative, predicting $2.81-$3.19. The truth? No one knows. RAY has lost 24.58% in the past month alone. Volatility is baked into its DNA.

Staking RAY gives you a share of trading fees, but yields fluctuate. Right now, APYs range from 5% to 12%, depending on the pool. Not bad, but not life-changing either.

Who Should Use Raydium?

Raydium isn’t for everyone. Here’s who it works for:

- Experienced DeFi users who already use Solana wallets and understand liquidity pools, slippage, and impermanent loss.

- Traders who prioritize speed and low fees over polished UIs. If you’re swapping tokens every day, Raydium saves you money and time.

- Liquidity providers looking to earn yield on Solana-based pairs. Raydium’s integration with Serum means deeper pools and better price impact.

Here’s who should avoid it:

- New crypto users - the wallet setup alone can be overwhelming.

- People who need customer support - there isn’t any. No email, no live chat, no ticket system. If you send funds to the wrong address? Too bad.

- Mobile-only traders - no official app. You’re stuck using a browser on your phone.

Security and Risks

Raydium has never been hacked. That’s a plus. But being on Solana means you’re exposed to Solana’s own risks. The network had major outages in 2022 and 2023. If Solana goes down, Raydium goes down with it.

Smart contracts are audited, but audits aren’t magic. They find bugs - they don’t prevent them. And because Raydium is decentralized, there’s no insurance fund if something breaks. Your money is only as safe as your private key.

Also, regulatory pressure is rising. The SEC has been targeting DeFi protocols. Raydium doesn’t have a legal entity or compliance team. That could change fast if governments start cracking down on decentralized trading.

Alternatives to Raydium

If Raydium feels too risky or too technical, here are your options:

- Orca - Also on Solana. Cleaner UI, better mobile experience, slightly lower liquidity. Great for beginners.

- Uniswap - Ethereum’s leader. Slower, pricier, but way more user-friendly and widely trusted.

- PancakeSwap - On BSC. Low fees, high yields, but less secure than Solana. Popular for memecoins.

- Soldex.ai - Newer Solana DEX. Better UI, AI-powered trading tools, but smaller liquidity pool.

Raydium still wins on liquidity depth within Solana. If you’re deep in the Solana ecosystem, it’s hard to beat.

Final Verdict: Is Raydium Worth It?

Raydium isn’t the easiest DEX. It’s not the safest. It doesn’t have a mobile app or customer service. But if you’re comfortable with DeFi, want lightning-fast trades, and pay under a penny in fees - it’s one of the best options on Solana.

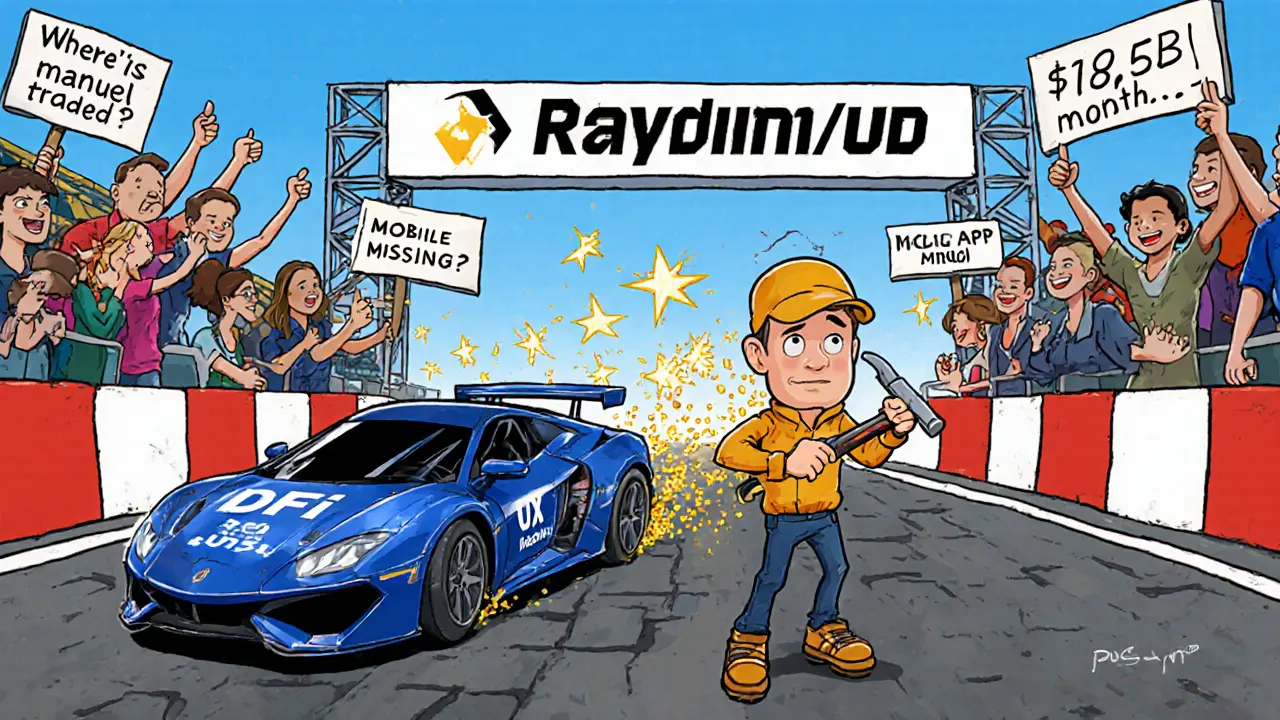

The low Traders Union score isn’t just noise. It reflects real friction: poor documentation, confusing interfaces, and zero hand-holding. But the volume tells another story: $18.5 billion traded monthly. That’s real demand.

Think of Raydium like a race car. It’s fast, powerful, and efficient. But you need a license, a mechanic, and the guts to drive it. If you’ve got those, it’s a top-tier tool. If you’re just learning to drive? Start with something simpler.

Raydium isn’t going away. It’s too deeply embedded in Solana’s DeFi stack. But its future depends on two things: Solana’s stability and Raydium’s ability to improve its UX. Until then, use it - but treat it like a tool, not a service.

Is Raydium safe to use?

Raydium has never been hacked, and its smart contracts have been audited. But safety in DeFi means you control your own funds. There’s no password reset, no customer support, and no insurance. If you lose your private key or send funds to the wrong address, there’s no recovery. Use Raydium only if you understand how to manage your own crypto securely.

Do I need a wallet to use Raydium?

Yes. You must connect a Solana-compatible wallet like Phantom, Solflare, or Coin98. You also need SOL in your wallet to pay for transaction fees - even small trades cost around $0.001-$0.01 in SOL. You can’t sign up with an email or create an account on Raydium.

Can I trade on Raydium using my phone?

There’s no official Raydium mobile app. You can access it through your phone’s browser, but the experience is clunky. Buttons are small, menus are hard to navigate, and it’s easy to make mistakes. For mobile trading, Orca or Phantom’s built-in swap feature are better choices.

What’s the minimum amount to trade on Raydium?

The minimum deposit is just $1. You can swap as little as $0.50 worth of tokens. But you still need enough SOL to cover transaction fees - around $0.10-$0.20 depending on network activity. So plan for at least $1.50-$2 to start trading.

Does Raydium have a mobile app?

No. Raydium does not offer a native mobile application. All trading must be done through a web browser on your phone or desktop. This is a major drawback for users who want to trade on the go. Wallet apps like Phantom offer integrated swap features that are more mobile-friendly.

How does Raydium make money?

Raydium earns revenue through trading fees. A 0.25% fee is charged on every trade. A portion of that fee is distributed to liquidity providers and RAY token stakers. The platform doesn’t charge withdrawal fees or account fees. Its business model relies entirely on volume and user participation in its liquidity pools.

Can I stake RAY tokens on Raydium?

Yes. You can stake RAY tokens in Raydium’s liquidity pools or lock them in governance staking contracts. Staking rewards come from a share of trading fees and sometimes additional token incentives. APYs vary between 5% and 12%, depending on pool demand and market conditions. Always check the current yield before staking.

If you're serious about trading on Solana, Raydium is one of the most powerful tools available - if you know how to use it. But if you’re still learning the ropes, start with Orca or a centralized exchange. Raydium isn’t a beginner’s platform. It’s a power user’s platform. And in crypto, that’s often where the real value lies.

Sunidhi Arakere

November 4, 2025 AT 10:40Raydium is fast and cheap. Good for experienced users. Not for beginners. Simple tools, simple rules. If you know what you're doing, it works.

Michelle Stockman

November 5, 2025 AT 04:24Traders Union gave it 1.86? That’s not a score, that’s a cry for help. If your UI is worse than a 2008 MySpace page, maybe fix the product before asking for trust.

Ryan McCarthy

November 6, 2025 AT 13:06I get the speed and cost benefits, but I’ve lost count of how many friends got burned because they sent SOL to a token contract by accident. No support means no safety net. That’s not freedom-it’s abandonment.

Fred Kärblane

November 7, 2025 AT 03:10Raydium’s liquidity depth is insane compared to Orca. If you’re doing high-frequency swaps or LPing on Solana, you’re not really considering alternatives. The UI is a pain, but the backend is elite DeFi engineering.

Diana Smarandache

November 7, 2025 AT 19:13The comparison to a race car is accurate. But a race car without airbags, seatbelts, or a mechanic is just a very fast coffin. The lack of customer support isn’t a feature-it’s a liability wrapped in ideology.

Glen Meyer

November 8, 2025 AT 10:42Why are we even talking about this? Solana is a joke anyway. The network crashes more than my old Windows XP. Raydium’s fine, but the whole chain is built on sand. America needs real blockchain, not this crypto casino nonsense.

Vivian Efthimiopoulou

November 9, 2025 AT 10:53DeFi is not a service-it is a philosophy. Raydium embodies the radical autonomy that crypto promised: no intermediaries, no gatekeepers, no apologies. The friction is not a bug; it is the feature that filters out the unprepared. Those who survive the learning curve become true stewards of decentralization.

Noah Roelofsn

November 10, 2025 AT 11:51People act like the UI is the whole story, but let’s talk about the real magic: the integration with Serum’s order book. That’s not just AMM + order book-it’s a hybrid beast that eats Uniswap for breakfast. The UI will catch up. The tech already won.

Kevin Mann

November 12, 2025 AT 00:42Look, I’ve been using Raydium since 2022. I’ve swapped everything from SOL to DogeMoonCoin v3. I’ve staked RAY, I’ve rug-pulled others, I’ve been rug-pulled. The interface is a nightmare, sure-but the fees are so low I don’t care if it looks like it was coded in Notepad in 2014. I’ve lost $12k on bad trades, but I saved $3000 in gas. That’s a net win. Also, if you’re using a phone browser? You’re doing it wrong. Use a desktop. Or better yet, get a Ledger and stop complaining.

Kathy Ruff

November 13, 2025 AT 12:38For anyone new to Solana: start with Phantom’s built-in swap. It’s Raydium under the hood but with a UI that doesn’t make you want to quit crypto. Once you’re comfortable, move to the full platform. Don’t jump into the deep end blindfolded.

Tara R

November 14, 2025 AT 07:3618.5 billion monthly volume? That’s not demand, that’s gambling. People are chasing memecoins like it’s a casino and Raydium is the slot machine with the prettiest lights. The real value is in the liquidity providers, not the speculators. And yet, everyone wants to be the next whale while ignoring the risk.

Sierra Rustami

November 14, 2025 AT 13:50Raydium is Solana. Solana is America’s blockchain. If you don’t like it, go back to Ethereum and pay $50 in gas. We don’t need your slow, bloated, overpriced chains here.

Alexis Rivera

November 15, 2025 AT 13:35There’s a deeper truth here: Raydium isn’t designed for users. It’s designed for systems. It’s a node in a larger machine. The people who thrive here aren’t traders-they’re architects. They don’t want hand-holding. They want raw access. That’s why the UI is sparse. It’s not broken. It’s intentional. The future of DeFi isn’t pretty. It’s functional.

Ryan Inouye

November 16, 2025 AT 11:51Why are we even giving this platform legitimacy? The SEC is watching. The network has crashed twice. The devs don’t even respond to GitHub issues. This isn’t innovation-it’s a house of cards held together by hype and Solana’s remaining credibility. You’re not a pioneer. You’re a sucker.

Cierra Ivery

November 17, 2025 AT 19:06Wait-so you’re telling me there’s NO mobile app… but you’re recommending it to people who want to trade on the go? That’s like selling a Ferrari… that only starts if you’re standing on a specific brick in your driveway. And you call that user-friendly?!

Allison Doumith

November 18, 2025 AT 00:36There’s something poetic about Raydium. It doesn’t beg for attention. It doesn’t flatter you. It just exists-cold, efficient, indifferent. Like a desert. You don’t go there for comfort. You go because you need to survive. And those who do? They become something else. Not traders. Not users. Survivors.

Stephanie Tolson

November 18, 2025 AT 12:10If you’re new, start with Orca. If you’re serious, use Raydium. But don’t confuse convenience with safety. The real power here isn’t in the swaps-it’s in the liquidity pools. That’s where the real yield lives. And if you’re staking RAY, you’re not just earning fees-you’re betting on Solana’s future. That’s not speculation. That’s conviction.

Steven Lam

November 18, 2025 AT 14:53Why do people keep acting like this is a bank? It’s not. It’s code. You break it, you lose it. No one owes you a refund. If you don’t like it, don’t use it. Simple. Stop acting like you’re entitled to customer service when you’re trading crypto on a blockchain.

Angie Martin-Schwarze

November 18, 2025 AT 19:44i just tried to swap usdc for ray and the page froze 3 times… i think my wallet is hacked or something… i dont know what to do… i think i lost my money…

Eric von Stackelberg

November 20, 2025 AT 13:41Have you noticed that every major DeFi platform that gains traction gets targeted by the SEC? Raydium has no legal entity. No headquarters. No compliance team. That’s not a flaw-it’s a feature. They’re building a system that cannot be shut down. The real question isn’t whether it’s safe. It’s whether you’re ready to live in a world where governments can’t touch your money.

Michelle Sedita

November 22, 2025 AT 00:29I used to hate Raydium’s UI. Then I started using it daily. Now I can’t imagine trading anywhere else. The speed is unreal. The fees are laughable. And once you get past the initial confusion, it’s kind of beautiful. Like learning to ride a bike-scary at first, then second nature.

Emily Unter King

November 22, 2025 AT 20:00For LPs: Raydium’s integration with Serum means better price impact and deeper liquidity than any other Solana DEX. The APYs may fluctuate, but the volume guarantees that your capital isn’t sitting idle. If you’re providing liquidity on Solana, you’re not just earning yield-you’re enabling the entire ecosystem.

Ryan Inouye

November 23, 2025 AT 07:21And yet, the fact that you need $0.10 in SOL just to swap $1 worth of tokens? That’s not accessibility. That’s a tax on the poor. You’re telling people to buy SOL just to trade? That’s not DeFi. That’s rent-seeking.