MyBricks ($BRICKS) Investment Calculator

Current Token Metrics

Price: $0.00024

Market Cap: $223,000

Supply: 1,000,000,000 tokens

Liquidity: Extremely Low (PancakeSwap only)

Risk Level: High Risk

Investment Parameters

Projected Results

Tokens Purchased: 0

Estimated Monthly Return: $0.00

Total Return Over Period: $0.00

Potential Profit/Loss: $0.00

Key Facts About $BRICKS

- Blockchain: Binance Smart Chain (BEP-20)

- Contract Address: 0x13e1070e3a388e53ec35480ff494538f9ffc5b8d

- Supply Cap: 1 Billion tokens

- Audit: Solidity Finance

- Yield Model: Rent 2 Rent

Ever stumbled across a crypto project promising a slice of the property market and wondered if it’s legit? That’s the story behind BRICKS token - a token that tries to blend real‑estate investing with blockchain. Let’s break down what MyBricks is, how it works, and whether it’s worth a look.

What is MyBricks?

MyBricks is a cryptocurrency platform that aims to make property investment accessible to anyone with a crypto wallet. Launched in July2021, the project was built by a team of 15 business owners, developers, and tech entrepreneurs based in the UK. The face of the team is Adam Callow, who is often cited as the founder in media coverage.

The core idea is simple: you buy the native token, $BRICKS, and your holdings are automatically allocated to a diversified fund of rental properties. The rent collected each month is then distributed back to token holders via smart contracts, offering a regular yield without the usual paperwork of traditional real‑estate investing.

Understanding the BRICKS Token

The BRICKS token is a BEP‑20 token on the Binance Smart Chain. Its contract address is 0x13e1070e3a388e53ec35480ff494538f9ffc5b8d. With a hard cap of 1billion tokens, the supply is fixed, which means no new tokens can be minted beyond that amount.

Security-wise, the token’s code was audited by Solidity Finance. The audit report confirmed that the contract follows standard BEP‑20 rules and that the yield‑distribution logic is free from major vulnerabilities.

Because it lives on BSC, transaction fees are tiny (often just a few cents) and trades settle within seconds - a big advantage over Ethereum‑based tokens that can suffer from high gas prices.

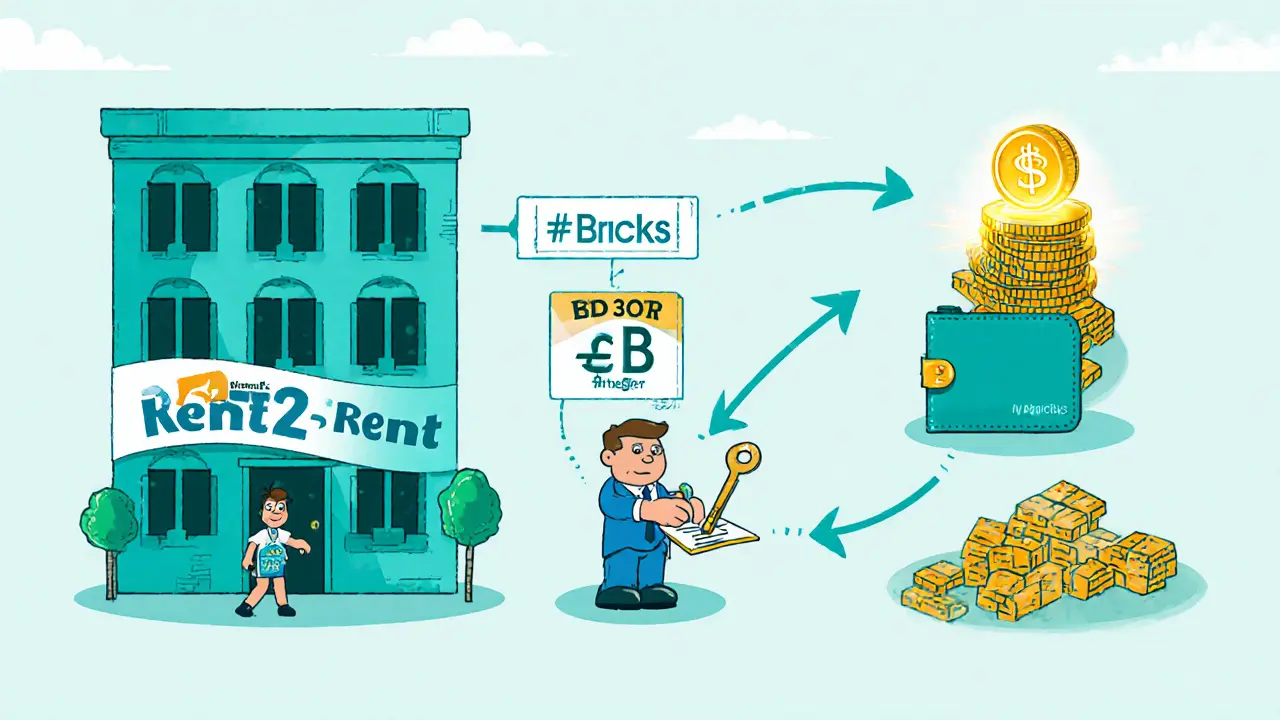

How the ‘Rent2Rent’ Model Works

MyBricks uses a strategy dubbed “Rent2Rent.” Here’s the flow:

- MyBricks leases a property from the owner at a market rate.

- The same property is sub‑let to a tenant at a higher price.

- The margin between the two rents funds the purchase of additional properties.

- Any rent collected after covering costs is funneled into the token’s smart contract and split among all $BRICKS holders.

Investors therefore benefit from two sources of income: the rental yield from the underlying assets and the potential upside if the token’s market price rises.

Each property fund also offers perks - low‑cost rentals on premium accommodation, discounts on home‑improvement services, and even a planned MyDebitCard that promises airport lounge access.

Buying and Storing BRICKS

Getting your hands on $BRICKS isn’t as straightforward as buying a mainstream coin on a big exchange. The token is listed only on decentralized exchanges, with PancakeSwap being the primary venue.

Here’s a quick step‑by‑step:

- Buy some BNB on a centralized exchange (e.g., Binance) and withdraw it to a wallet that supports BSC - MetaMask, Trust Wallet, or the upcoming MyBricks Wallet (if released).

- Connect your wallet to PancakeSwap.

- Paste the BRICKS contract address

0x13e1070e3a388e53ec35480ff494538f9ffc5b8dinto the “Select a token” field. - Swap your BNB for $BRICKS, confirm the transaction, and you’re set.

Remember to keep a small amount of BNB in your wallet to cover future transaction fees.

Current Market Snapshot

As of mid‑2023, the token’s market cap hovered around $223k, with a fully diluted valuation (FDV) of the same amount because the entire supply is already accounted for. The price has slipped dramatically from its all‑time high of $0.00493 in August2022 - a drop of roughly 95%.

Trading volume is another red flag. Depending on the data source, 24‑hour volume ranged from a few dollars to a few hundred dollars, representing less than 1% of the market cap. Low liquidity means price swings can be sharp if a large order hits the market.

Performance-wise, the token showed modest gains over short periods (e.g., +0.07% over 24h, +8.8% over a week) but lagged heavily against Bitcoin and Ethereum on an annual basis.

Pros, Cons, and Risks

What’s appealing?

- Direct exposure to real‑estate rent yields without needing thousands of dollars upfront.

- Low transaction fees thanks to BSC.

- Additional perks like the MyDebitCard and NFT marketplace (still under development).

- Audit by a reputable firm (Solidity Finance).

Where it falls short:

- Only one trading venue - PancakeSwap - leading to extremely low liquidity.

- Inconsistent price data across aggregators, which can confuse investors.

- No fiat on‑ramps; you must already own BNB.

- Regulatory uncertainty around tokenized real‑estate holdings.

- Roadmap items (wallet, NFT marketplace) have yet to materialise as of 2025.

Overall, the token suits people who are comfortable navigating DeFi tools and who want speculative exposure to property yield, rather than investors seeking a stable, income‑generating asset.

How MyBricks Stacks Up Against Competitors

| Feature | MyBricks | RealT | Brickken |

|---|---|---|---|

| Blockchain | Binance Smart Chain (BEP‑20) | Ethereum (ERC‑20) | Ethereum (ERC‑20) |

| Market Cap (approx.) | $0.22M | $15M | $5M |

| Liquidity Sources | PancakeSwap only | Multiple DEXs + some CEX listings | DEXs + partner exchanges |

| Yield Distribution Method | Smart‑contract rent split (Rent2Rent) | Direct rent payouts to token holders | Revenue‑share tokens |

| Additional Utilities | Planned MyDebitCard, NFT marketplace | Token‑gated property access | Asset‑backed token platform |

| Regulatory Status | Unclear, UK‑based team | Operates under U.S./EU guidance | EU‑focused compliance |

The table shows MyBricks is a niche player with the smallest market cap and the weakest liquidity. If you need a more robust secondary market, RealT or Brickken might feel safer.

Future Outlook and Roadmap

MyBricks announced a roadmap that included a dedicated wallet, property‑portfolio NFTs, and the MyDebitCard. As of late 2025, there’s still no public release of the wallet, and the NFT marketplace remains in a beta‑like state. That said, the broader tokenized‑real‑estate sector is projected to grow at a compound annual growth rate (CAGR) of about 14.5% through 2027, according to market research.

If MyBricks can secure listings on additional DEXs, improve its community engagement, and deliver on its utility promises, it could capture a modest slice of that growth. Conversely, without those steps, the token risks fading into obscurity, especially given its low trading volume and high price‑manipulation potential.

Key Takeaways

- MyBricks offers a crypto‑based gateway to rental‑property yields via the $BRICKS token.

- The token lives on Binance Smart Chain, has a fixed supply of 1billion, and is audited.

- Liquidity is extremely thin - only PancakeSwap - making large trades risky.

- Potential benefits (low fees, fractional ownership) are offset by regulatory uncertainty and unfinished product features.

- Investors should treat $BRICKS as high‑risk, speculative exposure rather than a stable income source.

Frequently Asked Questions

What does the $BRICKS token represent?

Each $BRICKS token gives you a proportional share in MyBricks’ property fund. The rent collected from the underlying real‑estate assets is automatically distributed to token holders through a smart contract.

How can I buy $BRICKS?

First acquire BNB on a centralized exchange, move it to a BSC‑compatible wallet, then use PancakeSwap to swap BNB for $BRICKS using the contract address 0x13e1070e3a388e53ec35480ff494538f9ffc5b8d.

Is $BRICKS a safe investment?

Safety is relative. The token is audited, but its liquidity is extremely low, price history shows a 95% drop from its peak, and regulatory frameworks for tokenized real‑estate are still evolving. Treat it as a high‑risk, speculative asset.

What are the ‘Rent2Rent’ profits?

MyBricks leases properties, sub‑lets them at higher rates, and keeps the margin. That margin funds additional purchases and is also shared with token holders as monthly rental yields.

Will MyBricks launch its wallet and NFT marketplace?

The roadmap lists a wallet and NFT marketplace for 2022‑2023, but as of 2025 there’s no public release. Keep an eye on official announcements for any updates.

Scott Hall

January 17, 2025 AT 22:18Liquidity on PancakeSwap is basically nothing, so any swing can move the price crazy.

Brandon Salemi

January 20, 2025 AT 05:52High risk, high reward vibe, but stay chill and keep a safety net.

Jade Hibbert

January 22, 2025 AT 13:25Oh sure, because a token with $0.00024 price is totally rock solid.

Leynda Jeane Erwin

January 24, 2025 AT 20:58In accordance with current market metrics, the token exhibits an elevated risk profile and limited tradable volume.

Annie McCullough

January 27, 2025 AT 04:32DeFi alchemy at its finest 💎🚀

Lena Vega

January 29, 2025 AT 12:05Noted.

Mureil Stueber

January 31, 2025 AT 19:38MyBricks positions itself on the Binance Smart Chain as a BEP‑20 token, which inherently offers lower transaction fees compared to Ethereum.

However, the token’s total supply of one billion and a market cap of just over $200 k indicate a severely under‑capitalized project.

The reported liquidity is described as ‘extremely low’ and is only available on PancakeSwap, meaning even modest trades can cause large slippage.

Such thin order books are a red flag for anyone looking to enter or exit positions without incurring massive losses.

The token’s yield model, dubbed ‘Rent 2 Rent’, promises monthly returns, but the mechanism behind those payouts is not transparently disclosed on the official site.

An audit by Solidity Finance is mentioned, yet the audit report is not publicly linked, leaving investors without a concrete verification of the code’s safety.

Given the absence of a clear use case beyond speculative yield, the token appears to rely heavily on new investor inflow to sustain returns.

This type of structure is reminiscent of classic pyramid or Ponzi dynamics, where early participants profit at the expense of later entrants.

Regulatory risk also looms, as many jurisdictions are tightening oversight on unregistered securities and high‑yield crypto schemes.

From a technical standpoint, the contract address is publicly visible, but without active community development, the long‑term viability remains questionable.

Potential investors should consider the opportunity cost of allocating capital to $BRICKS versus more established assets with proven liquidity.

Diversification across multiple projects can mitigate the impact of a total loss in a single high‑risk token.

If you choose to experiment, only allocate funds you can comfortably afford to lose, as the developer’s roadmap offers no guaranteed milestones.

Monitoring on‑chain activity such as wallet concentration and token burn events can provide early warning signs of manipulation.

In summary, $BRICKS presents an alluring high‑yield promise but is shrouded in liquidity scarcity, opaque mechanics, and substantial risk.

Emily Kondrk

February 3, 2025 AT 03:12The whole thing reeks of a pump‑and‑dump circus, and the only thing that's certain is that the next big whale will dump at any moment.

Laura Myers

February 5, 2025 AT 10:45Picture this: a token soaring on hype, then crashing into oblivion like a fireworks show gone wrong.

Leo McCloskey

February 7, 2025 AT 18:18One must question the moral compass of promoting such speculative ventures without adequate disclosure; this is bordering on irresponsible.

arnab nath

February 10, 2025 AT 01:52The contract address is publicly visible but the actual token flow remains opaque, suggesting centralized control.

Nathan Van Myall

February 12, 2025 AT 09:25Observing on‑chain data reveals concentration in a handful of wallets, which could trigger a cascade of sell‑offs.

debby martha

February 14, 2025 AT 16:58meh.

Ted Lucas

February 17, 2025 AT 00:32Don’t be fooled by the shiny promises – keep your risk management tight and your expectations low! 😊

ചഞ്ചൽ അനസൂയ

February 19, 2025 AT 08:05Even amidst chaos, a balanced mind can find lessons; investment is a mirror to our inner motivations.

Jacob Moore

February 21, 2025 AT 15:38Well said, staying grounded helps us navigate the wild crypto seas without capsizing.

Manas Patil

February 23, 2025 AT 23:12From a cultural perspective, emerging tokens like $BRICKS showcase the vibrant, albeit risky, creativity of the DeFi ecosystem.

Carol Fisher

February 26, 2025 AT 06:45Our nation’s financial future deserves better than unvetted tokens – stay vigilant! 🇺🇸

Melanie Birt

February 28, 2025 AT 14:18Absolutely, an informed community is the best defense against dubious projects. 👍

gayle Smith

March 2, 2025 AT 21:52Another hype‑driven meme token, same old story.