Energy Crisis Iran: Impact on Crypto Mining and the Market

When discussing energy crisis Iran, the severe shortage of electricity and rising power costs that the country faces. Also known as Iranian power shortage, it forces both households and businesses to rethink consumption patterns. One sector feeling the squeeze is cryptocurrency mining, the process of validating blockchain transactions using computer power. Because mining gobbles electricity, the crisis pushes miners to seek cheaper or greener sources, reshaping where and how new blocks are produced.

Another key player is renewable energy, solar, wind, and hydro power that can replace fossil‑fuel electricity. In regions hit by the Iranian crisis, renewable projects become attractive alternatives for miners looking to cut costs and avoid blackouts. This creates a feedback loop: energy scarcity drives investment in renewables, which in turn can stabilize mining operations and lower carbon footprints. Governments and regulators start to notice, leading to new crypto regulation, rules that control how digital assets operate within the energy market aimed at balancing economic growth with sustainable power use.

The broader blockchain, the decentralized ledger technology behind cryptocurrencies also feels the pressure. When power is scarce, transaction fees can spike as miners prioritize high‑value operations, and network speed may falter. This forces developers to explore energy‑efficient consensus models, like proof‑of‑stake, that require far less electricity than traditional proof‑of‑work. The shift influences everything from token design to user experience, making energy considerations a core part of blockchain strategy.

What This Means for Crypto Enthusiasts and Investors

For anyone watching the Iranian market, the crisis offers both risks and opportunities. On the risk side, volatile electricity prices can erode mining profitability, leading to sudden hash‑rate drops that affect coin prices. On the opportunity side, early movers who adopt renewable setups or switch to low‑energy protocols can capture market share when competitors falter. Moreover, regulators may hand out incentives for green mining, creating a niche where environmentally friendly projects thrive. Understanding how these forces interact helps traders pick assets that are resilient to power shocks and spot exchanges that support eco‑friendly tokens.

Below you’ll find a curated set of articles that dive deeper into each of these angles. From detailed exchange reviews that highlight fee structures to analyses of node distribution and staking returns, the collection gives you the practical tools you need to navigate the crypto world amid Iran’s energy crisis. Grab the insights, compare the data, and decide how to position your strategy in this evolving landscape.

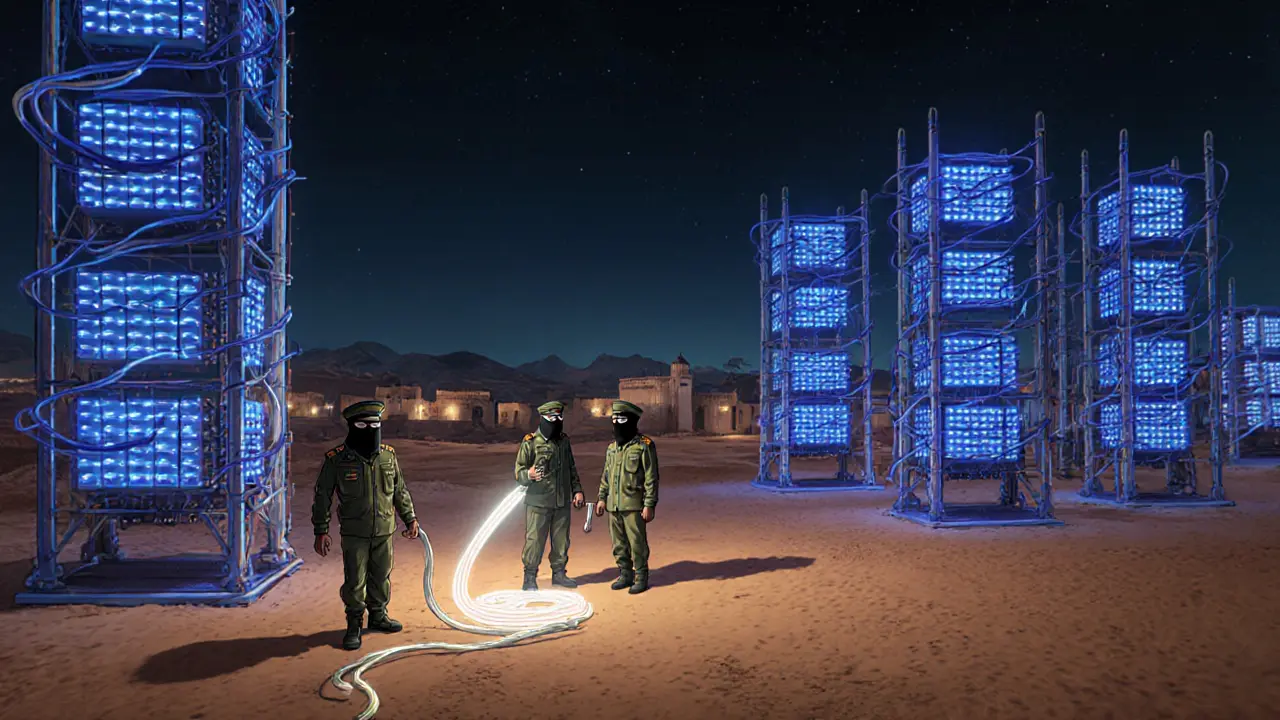

IRGC’s Unlicensed Crypto Mining in Iran: How the Guard Exploits Power

Explore how Iran's Islamic Revolutionary Guard Corps runs unlicensed crypto mines, steals cheap power, evades sanctions, and fuels the country's energy crisis.

- 25

- Read More